The Rise of Conscious Capital

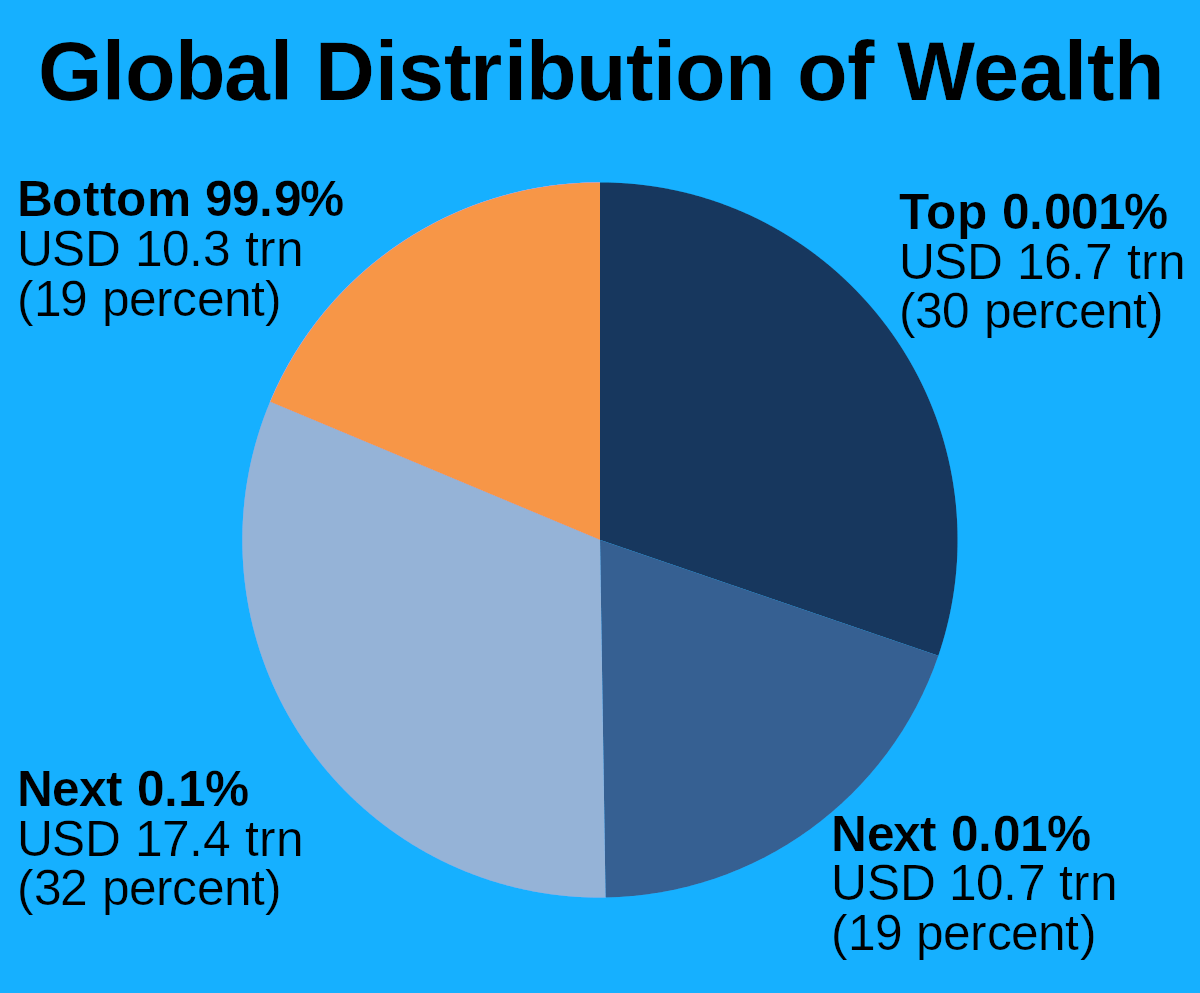

Disputed. Economist James S. Henry, 2012

---------------------

Men tend to rank us. This is hard power.

It creates friction, inequality and scarcity.

Women tend to link us. This is soft power.

It creates harmony, equality and abundance.

Even the bastions and beneficiaries of deeply flawed and inequitable capitalism and "democracy" have been calling for bold and urgent restructuring for a better world for all:

"The pandemic caused a deep economic and social recession. Rapid and effective implementation of recovery and investment plans will help support stronger and more sustainable growth." (OECD, 2021, paraphrased)

In its 2021 book "Stakeholder Capitalism" the World Economic Forum (WEF) argues for "A Global Economy that Works for Progress, People and Planet" with this refreshingly frank observation:

"Our global economic system is broken. But we can replace the current picture of global upheaval, unsustainability, and uncertainty with one of an economy that works for all people, and the planet. First, we must eliminate rising income inequality".

In 2022, BlackRock, the world's largest asset manager ($10 trillion) likewise called CEOs to avoid the path of Enron by embracing the logic of Stakeholder Capitalism:

"Truly great companies recognize the importance of engaging with and delivering for their key stakeholders. Stakeholder Capitalism is driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper." (paraphrased)

In 2022, Harvard Law School likewise argued for: "Stakeholder Capitalism and ESG as Tools for Sustainable Long-Term Value Creation".

As above, ESG was born in 1993! Stakeholder Capitalism was born in 1973! These are very mature concepts whose time for full implementation is long overdue. We have known the WHAT and WHY for a long time, but not the HOW. That has changed completely. We now know HOW in spades.